| Modo de transporte | Velocidad y plazos | Costo y caso de uso |

|---|

| Carga aérea | Muy rápido (a menudo de 1 a 7 días) | Costo más alto. Se utiliza para productos urgentes de alto valor o artículos de temporada que requieren reposición rápida. |

| Transporte marítimo | Lento (~4–6 semanas Asia–Europa) | El menor costo por unidad. Ideal para envíos masivos de bienes duraderos (ropa, electrodomésticos) que no son urgentes. |

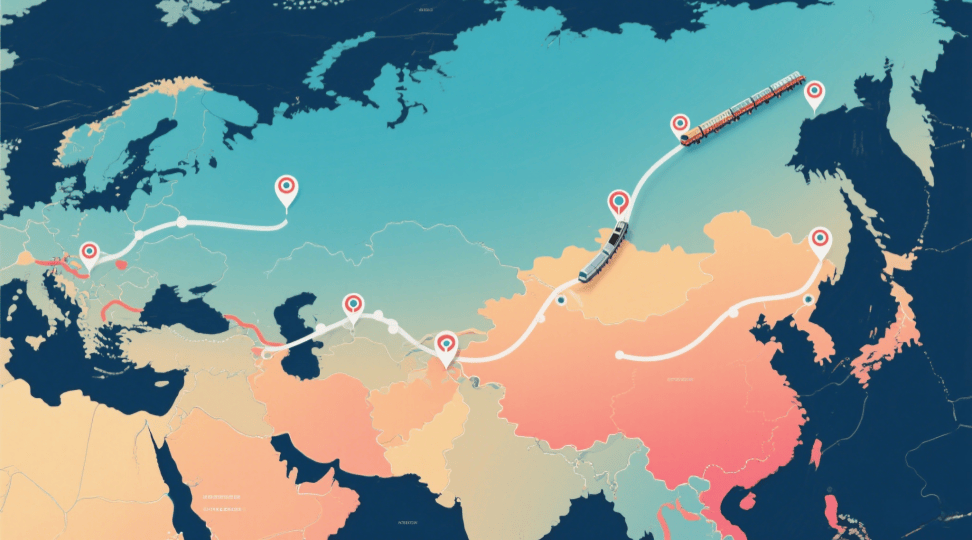

| Transporte ferroviario de mercancías | Moderado (2-3 semanas China-UE) | Costo moderado. Ideal para cargas grandes de contenedores en rutas fijas (p. ej., China-Europa vía Kazajistán/Rusia). Más rápido que el transporte marítimo, pero menos flexible en la entrega final. |

| Carretera (Camión, TIR) | Variable (días a semanas) | Costo moderado a alto. Ofrece servicio puerta a puerta. El transporte TIR para envíos minoristas (camiones precintados) es eficiente para rutas terrestres transfronterizas, especialmente dentro de Eurasia. |

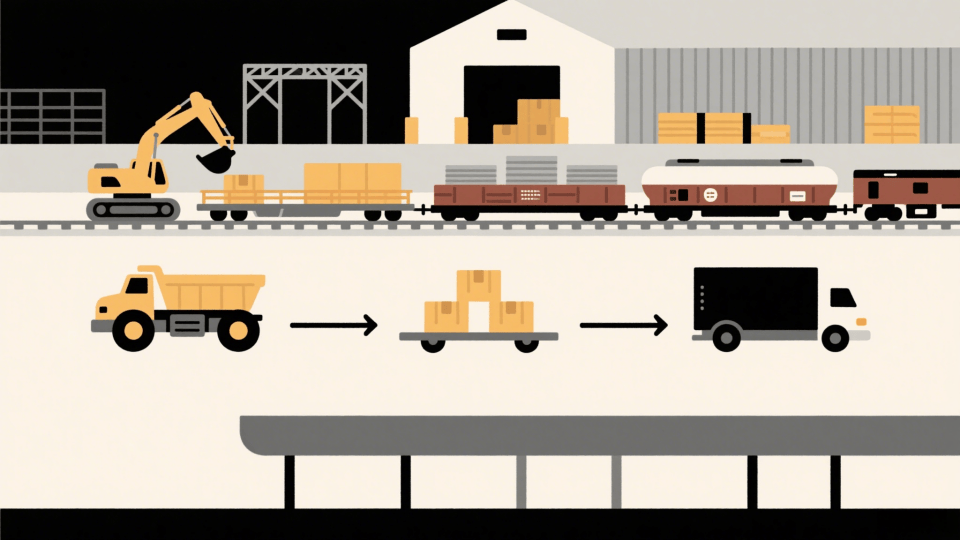

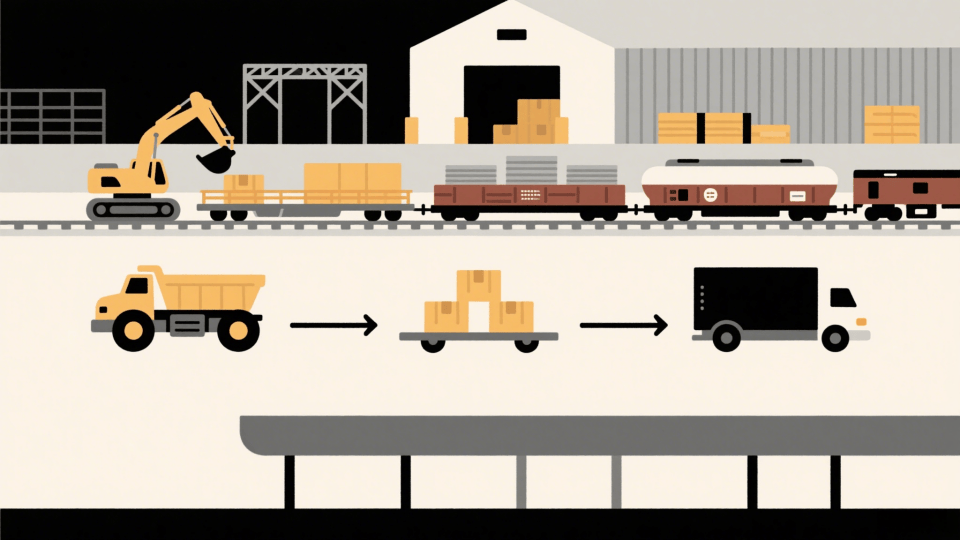

El análisis de la industria señala que la adopción de transporte multimodal El transporte marítimo, que combina camiones, barcos, vagones de ferrocarril y aviones, está creciendo rápidamente para reducir costos y tiempos de tránsito. Por ejemplo, un minorista puede enviar mercancías por mar a un puerto del norte de Europa y luego transportarlas al interior por ferrocarril o camión. Otro patrón común es utilizar Transporte por carretera TIR Para la entrega final: los camiones que transportan contenedores sellados con permisos TIR pueden cruzar múltiples fronteras (China–Kazajstán–Rusia–Bielorrusia–Polonia–Alemania) con controles mínimos. En resumen, elegir las soluciones logísticas minoristas adecuadas implica hacer concesiones: transporte aéreo para mayor velocidad, transporte marítimo para mayor precio, transporte ferroviario para mayor equilibrio y transporte terrestre para mayor flexibilidad.

Logística ferroviaria en Asia Central

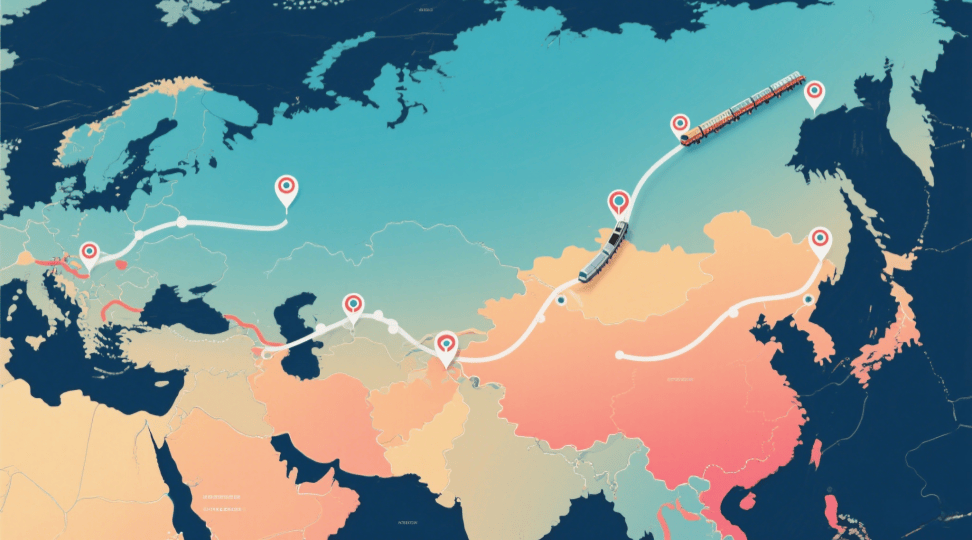

La logística ferroviaria en Asia Central está evolucionando rápidamente para conectar Asia y Europa a través de nuevos corredores. Históricamente, la mayor parte del transporte ferroviario de mercancías de China a Europa se realizaba hacia el norte a través de Kazajistán, Rusia y Bielorrusia. Hoy en día, se están implementando nuevas rutas del "Corredor Medio" a través de Asia Central y el Cáucaso, ofreciendo alternativas a los minoristas. Por ejemplo, en marzo de 2025, Kazajistán puso en marcha un servicio ferroviario directo entre China y Polonia a través de Turkmenistán, Irán y Turquía. Esto evita las rutas tradicionales y permite un suministro ininterrumpido entre China y Europa. A finales de 2024, China inauguró un nuevo ferrocarril China-Kirguistán-Uzbekistán (CKU), con un coste de 8.000 millones de dólares —otro proyecto de la Franja y la Ruta—, que proporciona una conexión terrestre más corta entre China y Europa.

Estos avances permiten a los transportistas minoristas elegir rutas más rápidas o fiables según el volumen de comercio. Un informe destaca que se prevé que el volumen de carga en el "Corredor Medio" se duplique con creces para 2027. En la práctica, la moda o la electrónica destinada a clientes europeos podrían transportarse por ferrocarril a través de Kazajistán (ruta norte) o de Uzbekistán (ruta sur), lo que sea más rápido o económico. A continuación, se presentan los avances ferroviarios más recientes:

Enlace ferroviario entre China y Polonia (2025)Un nuevo tren de contenedores circulará de Xi'an a Varsovia a través de Kazajstán, Turkmenistán, Irán y Turquía, garantizando una conexión ininterrumpida entre China y la UE.

Ferrocarril China-Kirguistán-Uzbekistán (CKU) (diciembre de 2024):Una importante línea del Cinturón y la Ruta que conecta directamente a China con Kirguistán y Uzbekistán, ofreciendo un corredor China-Europa más directo.

Crecimiento del Corredor MedioKazajstán está mejorando sus vías y espera que el transporte de mercancías en el corredor Transcaspio aumente aproximadamente un 220 % para 2027, lo que refleja el auge de los envíos ferroviarios.

Estas nuevas rutas complementan las líneas clásicas del Transiberiano. Al apoyar... Logística ferroviaria en Asia CentralLos minoristas ganan flexibilidad: si una ruta se ralentiza (debido a la congestión o el mal tiempo), se puede utilizar otra. Este efecto de red es fundamental en las estrategias modernas de la cadena de suministro minorista.

Transporte por carretera y TIR para envíos minoristas

El transporte por carretera sigue siendo crucial, especialmente para la entrega regional y el servicio de última milla. Los camiones transportan mercancías hacia y desde puertos, terminales ferroviarias y almacenes. En Eurasia, TIR (Transportes Internacionales Ruteadores) El convenio aduanero facilita enormemente el transporte transfronterizo. Con el TIR, un camión o contenedor precintado transporta carga a través de varios países bajo un mismo documento aduanero. Por ejemplo, en abril de 2025, China inauguró una ruta TIR por carretera que une Shenyang (noreste de China) con Tashkent (Uzbekistán) vía Kazajistán. En el primer trayecto, dos camiones TIR refrigerados transportaron 20 toneladas de helado desde Shenyang y llegaron a Tashkent en tan solo 8-10 días, un viaje que normalmente tomaría mucho más tiempo con los procesos más antiguos. Al eliminar la necesidad de inspecciones aduaneras completas en las fronteras intermedias, Transporte TIR para el comercio minorista Los envíos reducen retrasos y papeleo.

En términos más generales, el transporte de mercancías por carretera se utiliza cuando se necesita flexibilidad. Por ejemplo, los camiones recogen contenedores en los centros ferroviarios o puertos y los entregan directamente a tiendas o almacenes locales. Los minoristas pueden utilizar camiones TIR refrigerados para productos perecederos, plataformas para artículos de gran tamaño o tractores estándar para carga regular. Y dado que Rusia y muchos países de Asia Central forman parte del sistema TIR, un palé que viaja de China a Alemania puede cruzar Kazajistán, Rusia y Bielorrusia con un solo permiso TIR. En resumen, el transporte por carretera/TIR en la logística minorista proporciona conexiones cruciales de última milla y regionales que complementan el transporte marítimo y ferroviario de larga distancia.

Soluciones integrales de transporte de mercancías y logística minorista

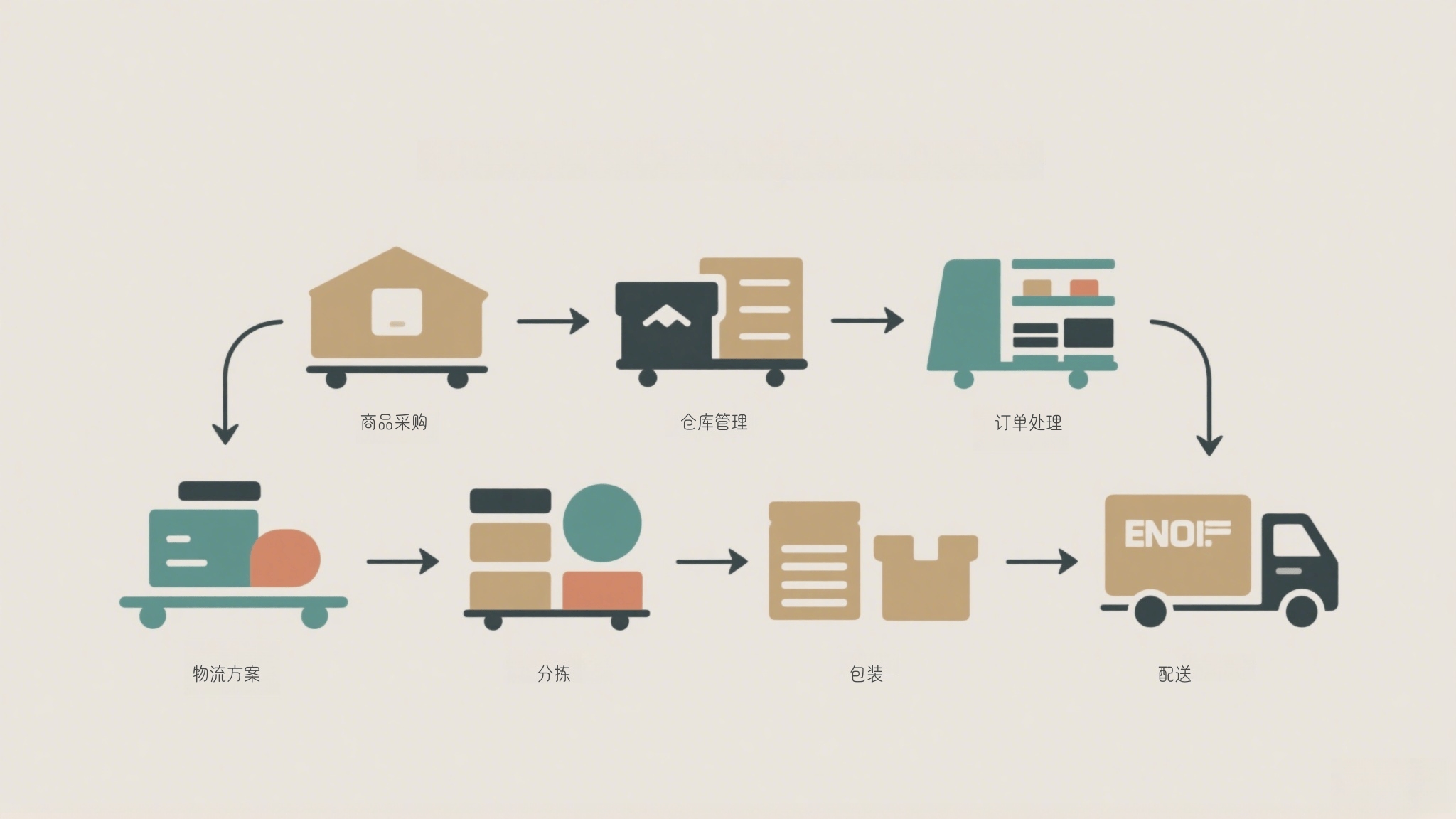

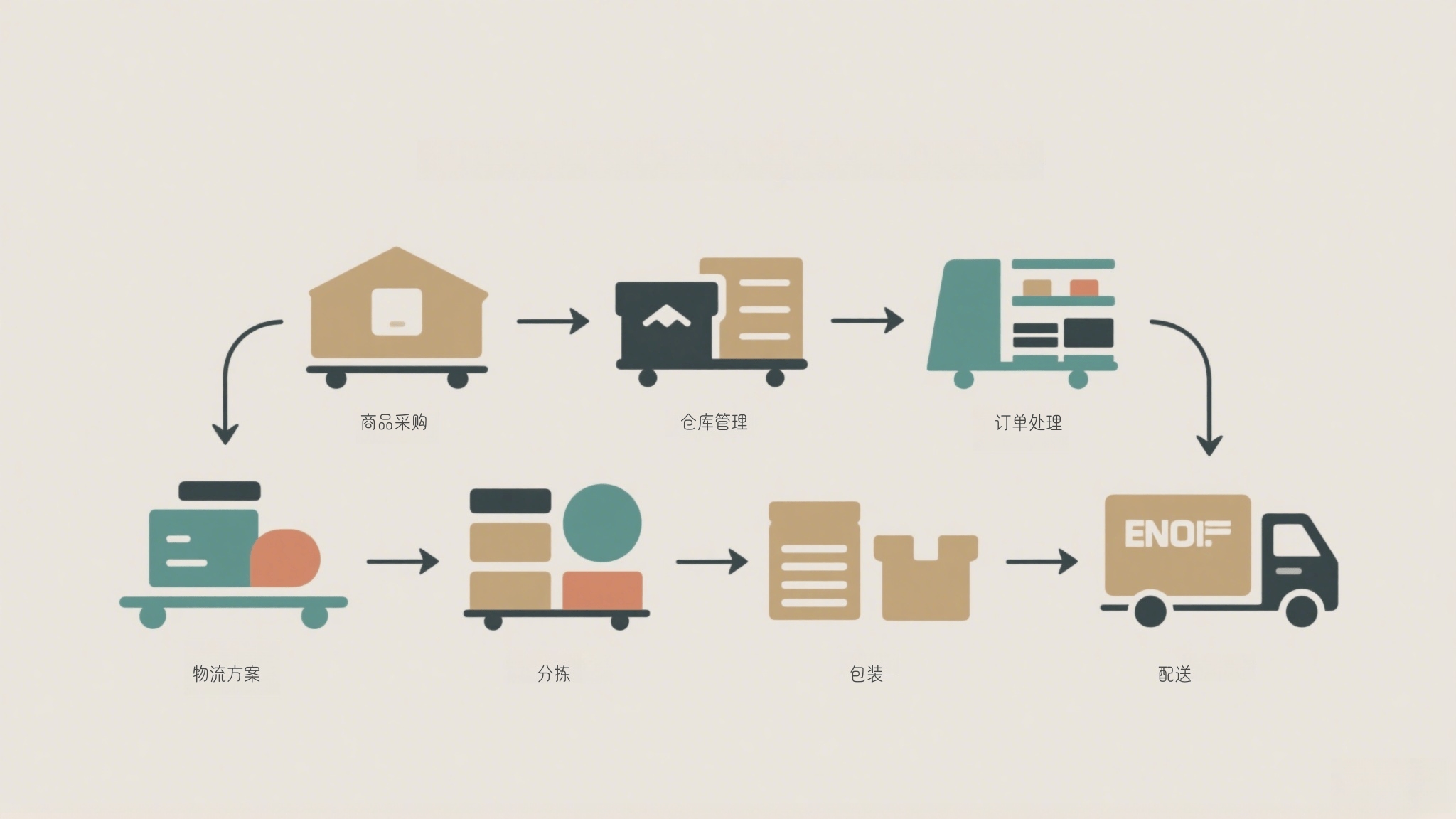

Los minoristas se benefician de soluciones logísticas de extremo a extremoUna empresa de transporte de mercancías o un socio 3PL puede coordinar cada etapa de un envío. Por ejemplo, una cadena de supermercados en Rusia que recibe mercancías de China podría contratar a un transportista para organizar la recogida en fábrica, consolidar las mercancías de varios proveedores en contenedores, reservar un tren entre China y Europa, gestionar las aduanas en la frontera bielorrusa y, finalmente, despachar los camiones a cada centro de distribución. El transportista rastrea la carga en cada etapa y resuelve cualquier problema (como retrasos) que surja. También suelen ofrecer servicios minoristas de valor añadido: gestión de inventario, preparación de pedidos y empaquetado, e incluso un simple cambio de marca si es necesario. Como señala un experto, los transportistas gestionan eficazmente el almacenamiento y el papeleo para que el minorista no tenga que hacerlo.

Muchas empresas ahora anuncian planes integrales soluciones logísticas para minoristasPor ejemplo, los proveedores 3PL modernos promueven soluciones de logística minorista como sistemas integrados de gestión de inventario y centros de cumplimiento omnicanal. Transporte de mercancías para empresas minoristas A menudo implica agrupar envíos más pequeños en cargas de contenedores más grandes o proporcionar un manejo especial (por ejemplo, servicios de guante blanco o gestión de devoluciones). Un sistema ágil cadena de suministro para el comercio minorista Enfatiza la visibilidad en tiempo real: los minoristas pueden acceder a un panel para ver exactamente dónde están sus productos y cuándo llegarán. Al elegir el socio logístico adecuado, los minoristas garantizan un transporte eficiente de sus productos a través de rutas internacionales complejas. Con sistemas robustos y redes globales, un minorista puede concentrarse en las ventas mientras su transportista se encarga del resto.

La logística minorista moderna también se apoya en la tecnología. Muchas empresas utilizan software para optimizar las rutas, automatizar la documentación y rastrear los envíos. El seguimiento en tiempo real y la notificación anticipada de llegadas mejoran la planificación de las tiendas. Si bien la tecnología está transformando la logística, el servicio principal sigue siendo el mismo: entregar la mercancía a tiempo. Al mantener redes de camiones, barcos, trenes y aviones, los proveedores de logística ofrecen a los minoristas opciones para diferentes necesidades. Por ejemplo, un minorista de moda podría enviar un buque portacontenedores a los puertos mediterráneos de Europa a bajo coste, mientras que un proveedor de electrónica podría optar por el transporte aéreo para una entrega más rápida. En todos los casos, los transportistas y los 3PL integran estos elementos en una solución integral.

DR Trans: Logística integrada para el comercio minorista internacional

Una buena ilustración de estos principios es DR Trans (Transporte ferroviario de Dear)DR Trans es una empresa de logística con sede en China (fundada en 2015) centrada en las rutas comerciales que más interesan a los minoristas. Su sitio web afirma que se centra en servicios de transporte de carga para China-Europa, China-Rusia, China-Bielorrusia y China-Asia Central, precisamente los corredores que conectan los mercados objetivo (China, Rusia, Bielorrusia, Alemania y Asia Central). DR Trans opera su propia flota de camiones (plataformas, refrigerados y contenerizados) para el transporte internacional TIR y opera trenes bloque dedicados China-Europa. En resumen, DR Trans ofrece soluciones logísticas minoristas multimodales bajo un mismo techo.

Por ejemplo, DR Trans ofrece un servicio puerta a puerta. Pueden recoger contenedores en una fábrica en Shanghái, cargarlos en un tren China-Alemania (vía Bielorrusia) y luego transferirlos a camiones TIR para su entrega final en Alemania o Polonia. Si un envío necesita llegar a Uzbekistán, podrían optar por una ruta a través de Kazajistán o la nueva línea ferroviaria CKU. El sitio web de DR Trans destaca que ofrece servicios de transporte intermodal por ferrocarril, carretera, aire y río-mar, así como envíos y almacenamiento. En otras palabras, gestionan todo, desde la reserva hasta la aduana y el seguimiento, en nombre de sus clientes minoristas.

Al asociarse con una empresa como DR Trans, un minorista obtiene un único punto de contacto durante todo su recorrido. El equipo de logística del minorista no tiene que comunicarse con múltiples transportistas: DR Trans coordina trenes, camiones y aviones según sea necesario. Por ejemplo, DR Trans anuncia que su servicio TIR entrega los envíos a tiempo de forma rutinaria al optimizar las rutas China-Kazajistán-Rusia, e incluso promete una reducción de aproximadamente el 50 % en el tiempo de despacho de aduanas mediante el uso de cuadernos precertificados. Este nivel de experiencia permite enviar productos minoristas (productos frescos, ropa, electrónica, etc.) sin problemas. En resumen, DR Trans ejemplifica la fluidez de la gestión. La logística en la industria minorista Se puede lograr a través de una plataforma integrada.

Conclusión

Una logística eficaz es la columna vertebral del comercio minorista moderno. De hecho, las ventas globales de comercio electrónico podrían crecer desde aproximadamente... 19 billones de dólares en 2022 a 48 billones de dólares Para 2030, se ejercerá una presión adicional sobre los minoristas para que entreguen sus productos con rapidez. Para las empresas que comercian entre China, Rusia, Bielorrusia, Alemania y Asia Central, la eficiencia... La logística en la industria minorista Significa convertir largas rutas internacionales en un inventario de tienda confiable. Al combinar el transporte aéreo, marítimo, ferroviario y terrestre (incluido el transporte TIR) en un solo plan, los minoristas pueden minimizar los tiempos y costos de tránsito. Por ejemplo, proveedores integrados como DR Trans gestionan todo el recorrido de un envío por ferrocarril, carretera, aire y mar desde una única plataforma, gestionando el despacho de aduanas y el almacenamiento en nombre de los minoristas.

Para los minoristas de estas regiones, es sólido La logística en la industria minorista Esto significa que los productos se mantienen en stock y los clientes satisfechos. En definitiva, una logística fluida en el sector minorista es clave para satisfacer la demanda de los clientes en el mercado interconectado actual. Al elegir socios logísticos experimentados y soluciones multimodales, los negocios minoristas pueden superar grandes distancias y fronteras complejas, garantizando que los productos lleguen a los estantes y a las puertas de forma eficiente.

IPv6 RED SOPORTADA

IPv6 RED SOPORTADA